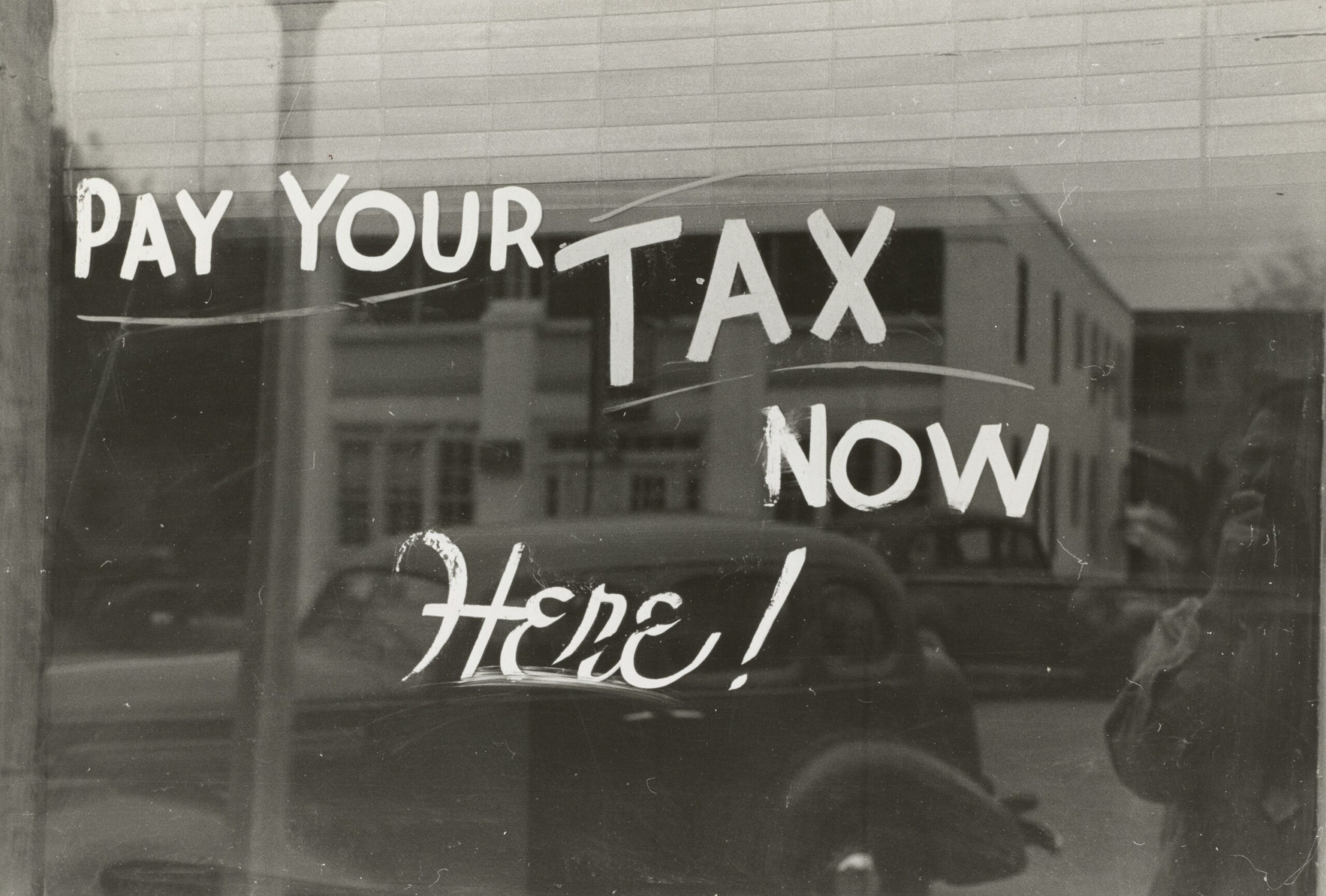

There are two things certain in life: death and taxes.

So said Benjamin Franklin.

With that cheerful thought in mind, I’d like to bring to your attention something important.

It concerns two things.

First, what you will leave behind for your family as an inheritance.

Second, what you can do to stop the government from hoovering up more and more of what you’ve worked for.

Consider this.

By 2029, the number of estates liable to pay inheritance tax will double (The Mail on Sunday, 28 September 2025).

Why will that happen?

- The nil tax rate threshold is currently £325,000

- It dates from 2009, when property prices across the country were far lower than today

- From 2026, HMRC will include unspent pensions within assessments for inheritance tax purposes

And, there may also be other new “hoovering” measures announced in November’s budget.

So what can you do to protect your estate?

One answer, as highlighted in the Mail on Sunday’s article, is a Life Insurance policy written in trust.

Keep in mind that Death Duty is currently 40% of any estate monies over £325,000 or over £500,000 if your home has been gifted to your children or grandchildren.

A life insurance policy can provide a lump sum that goes towards payment of death duties.

If part of a trust, the proceeds are not treated as part of an estate and can be used to pay an Inheritance Tax liability.

Like all things financial, individual circumstances and wishes vary.

And that’s where I can help.

I provide unbiased advice for wills, trusts and estate planning.

These are things best done when you don’t need them, so that when you (and your family) do, the best possible financial arrangements kick into place.

To arrange a call or meeting to discuss your estate planning, email [email protected] and I will be in touch.

Graham